Your Auto Insurance Company Hates This: How American Drivers Are Saving Big!

New discounts for American Drivers! A weird loophole is driving down premiums – but ONLY for short-distance drivers with no DUIs. This deal's clock is ticking, causing a frenzy with local insurance agents.

Do Not Pay Your Car Insurance Bill Until You Read This

In the wake of last year's high inflation, American drivers are bracing for a significant uptick in auto insurance premiums.

Recent findings from Bankrate reveal a startling 26% surge in car insurance rates since 2023, with projections indicating no relief until at least 2025.

The annual expense for comprehensive car insurance has skyrocketed to $2,543 in 2024, up from $2,014 the previous year, marking a substantial financial burden for many.

How to pay less for car insurance

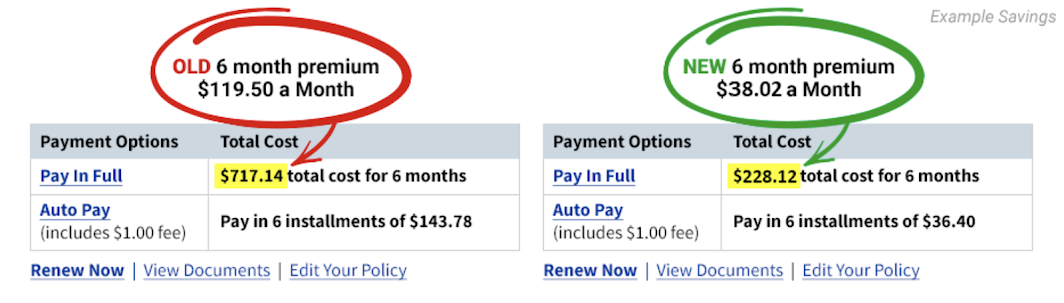

Money.com says to bring down car insurance costs, drivers first need to make sure they're getting the best deal possible.

This means for most drivers it's time to switch auto insurance companies.

This has been a hassle for a long time because the insurance system is set up to make drivers call around to gather quotes. And this leads to higher rates overall because drivers can't compare easily.

Fortunately, comparing insurance quotes has become easier, thanks to online platforms like PolicyWagon.com. This insider tip is being posted all over local message boards, and insurance companies are starting to get aware. So many drivers are acting fast.

Here’s How To Get Started:

Step 1: Select Your Age Group Below!

Step 2: Enter your vehicle year, make and model on the next page to get the lowest rates from top insurers